By, Kevin Kaiser, Commercial Director for Anue Water Technologies

Well-operated municipalities evaluate and compare projects to demonstrate to their constituency that they are using taxpayer funds in the most efficient and effective manner with the intent that they return more value than they cost.

Common methods to evaluate projects are payback period (payback), net present value (NPV), and internal rate of return (IRR). Operations staff may have a higher priority in replacement costs and short-term paybacks, while financial management and capital budgeting will look further into the future and consider long-term costs and planning.

Other reasons an entity could choose one project over another include risk of loss or failure, environmental compliance, community goodwill, green appeal, and personal preference; however, experience reveals that they will always evaluate the numbers.

Anue Water Technologies FORSe systems provide high NPV for collection systems using greater than 100 gallons per day of calcium nitrate. Coupled with financing options, Anue’s FORSe systems can often provide less than one-year payback, as well as 10- or 20-year NPV over $1 million, and an IRR that will far exceed the average water utility WACC (Weighted Average Cost of Capital) of 4.13 percent (Damodaran, 2022).

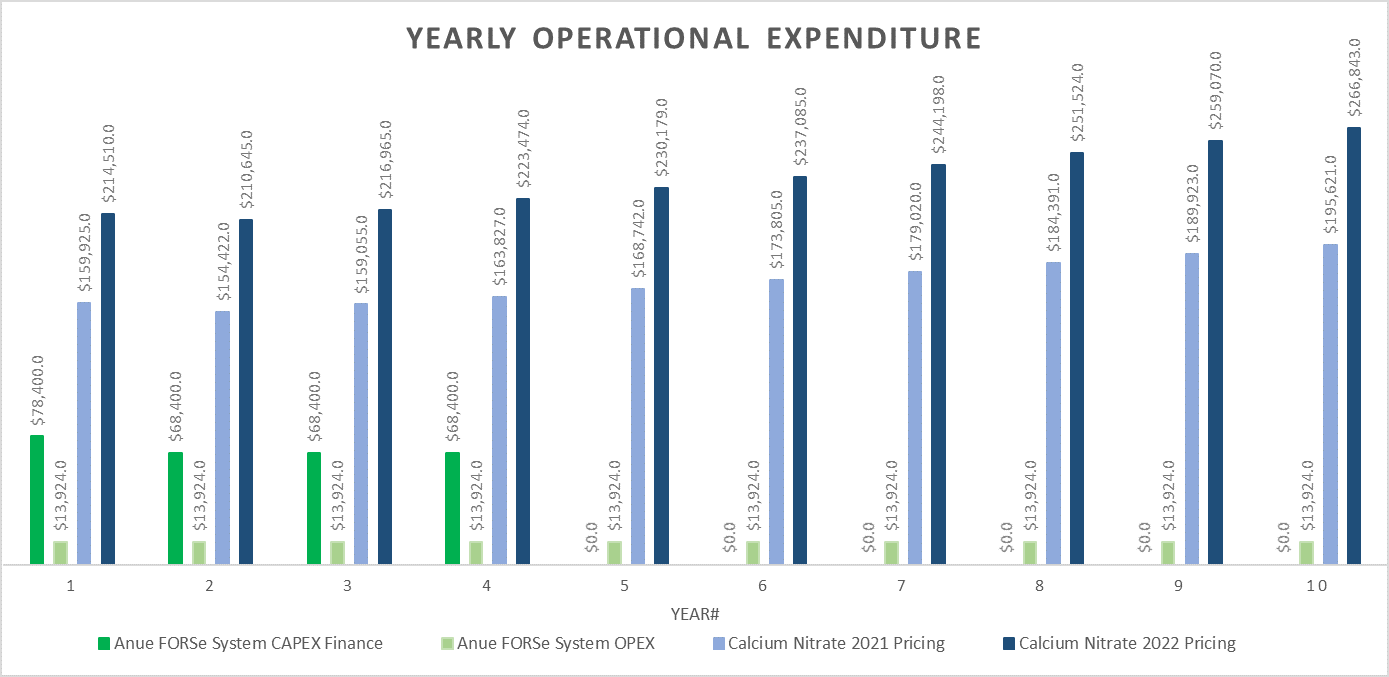

In the bar graph below, a financed capital purchase (green bars) generates a payback in the first year against the cost of chemicals, which were expected to increase in price. Operating costs (light green) over 10 years expect to be a fraction of chemical costs. NPV exceeds $1 million with an IRR greater than 50 percent.

The payback period is the number of years required to recover the full cost of a project from the savings it generates. The cumulative savings of the project are subtracted from the initial upfront costs until the full cost is recovered (Brigham & Ehrhardt, 2011, p. 401). Paybacks over one or two years demonstrate short-term impact, but do not consider a project’s savings in future years beyond the payback period. If chemical costs are replaced by a capital equipment project, the payback could be short, but over time price increases would have a greater impact on future savings.

The payback period is the number of years required to recover the full cost of a project from the savings it generates. The cumulative savings of the project are subtracted from the initial upfront costs until the full cost is recovered (Brigham & Ehrhardt, 2011, p. 401). Paybacks over one or two years demonstrate short-term impact, but do not consider a project’s savings in future years beyond the payback period. If chemical costs are replaced by a capital equipment project, the payback could be short, but over time price increases would have a greater impact on future savings.

Discounted cash flow analysis is the process of calculating the NPV of a project. NPV equals the present value of future cash flows (savings) discounted at the WACC minus the present value of the costs (total equipment plus installation). Discounting is the process of calculating the present value of future cash flows as opposed to compounding which is the process of calculating the future value of a cash flow; like a bank account that will have a future value based upon earnings at a specific interest rate (Brigham & Ehrhardt, 2011, pp. 134, 383).

Discounting in project evaluation is useful when a project has savings over a longer period like ten or twenty years. The calculated NPV is like writing a check today for that value. In the case of saving money on future spending, those funds could be allocated to other projects. In our example for 2021 savings on calcium nitrate spending, the check is $1,011,000 (not financed purchase).

The IRR is the discount rate where the NPV of the project is equal to zero. Calculating this rate forces the savings to be discounted at such a rate that they balance the initial cost of the project. The IRR demonstrates a rate of return for the project (Brigham & Ehrhardt, 2011, p. 387). A good rate is if the IRR exceeds the WACC as well as an entity’s internal “hurdle” rate, which is the interest rate that an entity could earn on their money if they put it into other investments (Kenton, 2021). In our example, the IRR is 57%. Think about what projects you have or investments you could make that will return 57% on your money.

Anue Water Technologies can demonstrate the financial benefits for your project in addition to the outstanding benefits of onsite pure oxygen generation using FORSe Systems. Let us help you with the numbers.

Works Cited

Brigham, E. F., & Ehrhardt, M. C. (2011). Financial Management: Theory and Practice. South-Western Cengage Learning.

Damodaran, A. (2022, January 1). Cost of Equity and Capital. Retrieved from NYU Stern: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/wacc.htm

Kenton, W. (2021, September 4). Hurdle Rate. Retrieved from Investopedia: https://www.investopedia.com/terms/h/hurdlerate.asp